When I graduated from Georgia Tech in May 2023, Facebook was one of the largest employers of computer science graduates from my class. Their approximate starting offer for new grad software engineers in the Bay Area was $200,000/year, which included $50k/yr of Meta stock.

Most of my classmates that graduated in Fall 2022/Spring 2023 were offered this compensation package. At the time, Meta was trading at $90/share. The following two years would be a tremendous rally for Meta stock. As I am writing this, Meta is trading at $720/share. For those that held on to their Meta stock, and presumably got refreshers annually, it would not be unreasonable to expect they have made as much as $2M in their time there, which might grow further as the stock continues to appreciate over the next two years.

Meta stock price chart showing massive rally from $90 to $720 over two years

Meta has been an outlier, with a well-timed dip right as my class was graduating and entering the workforce, and 8 consecutive quarters of blockbuster performance. That said, most of the other tech giants that hired a majority of my graduating class, Google, Microsoft, Amazon, and Nvidia, have all done very well.

Indeed, working at a large technology company has been an excellent financial decision for technically capable people over the last few years.

Working at a Startup

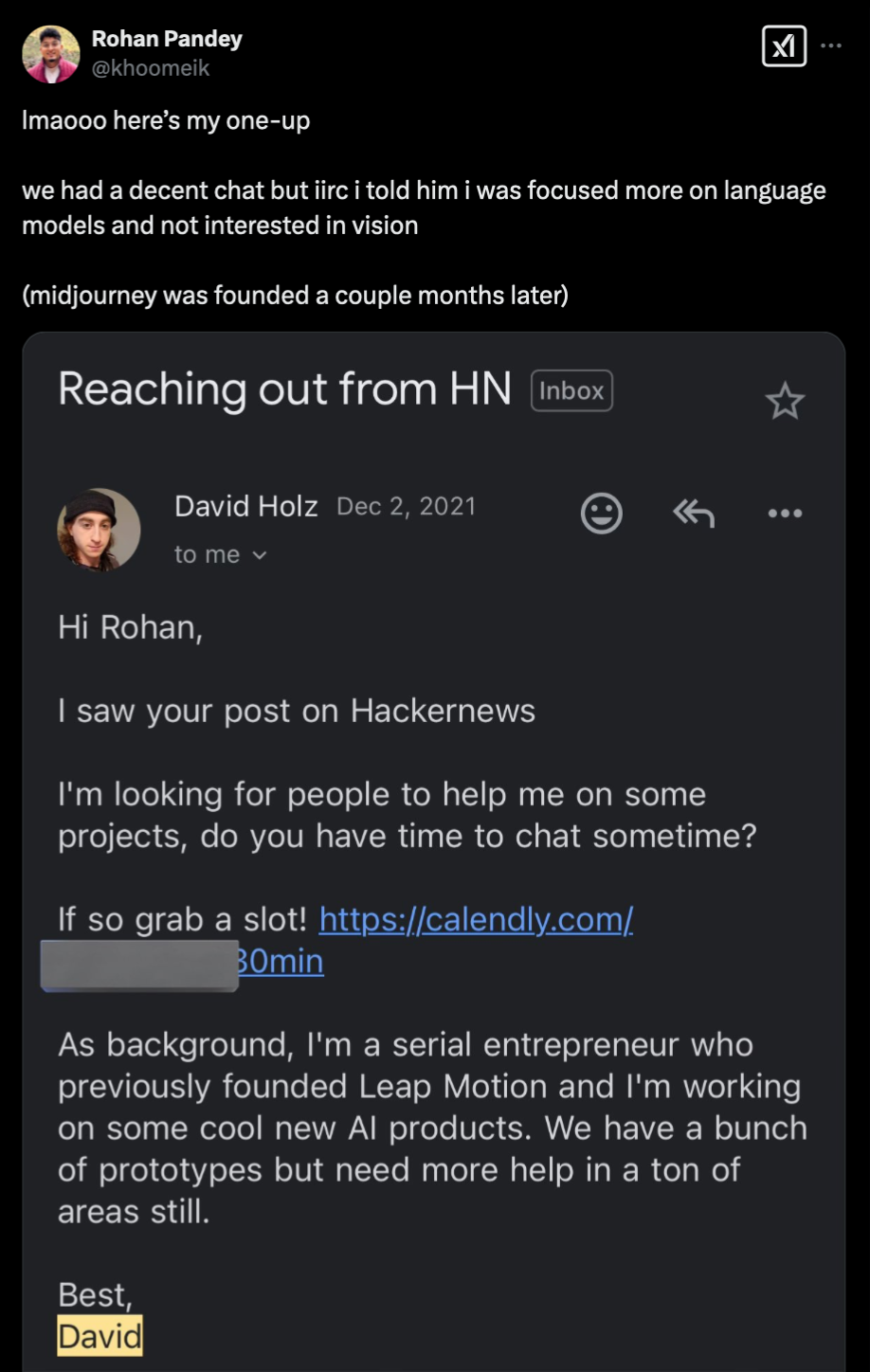

Recently, various engineers in Silicon Valley have been sharing on Twitter their “worst fumbles” - declining offers/interviews to be founding engineers at startups that years later have turned out to be extremely valuable.

Presumably, a founding engineer at Midjourney or Cursor would have received ~1% of the company as part of their compensation. Even with dilution, their shares would have been worth over $10M just a few short years later.

Joining a rocketship startup at the right time has also been an excellent financial decision for technically capable people over the last four years.

What are the differences?

Cash Compensation

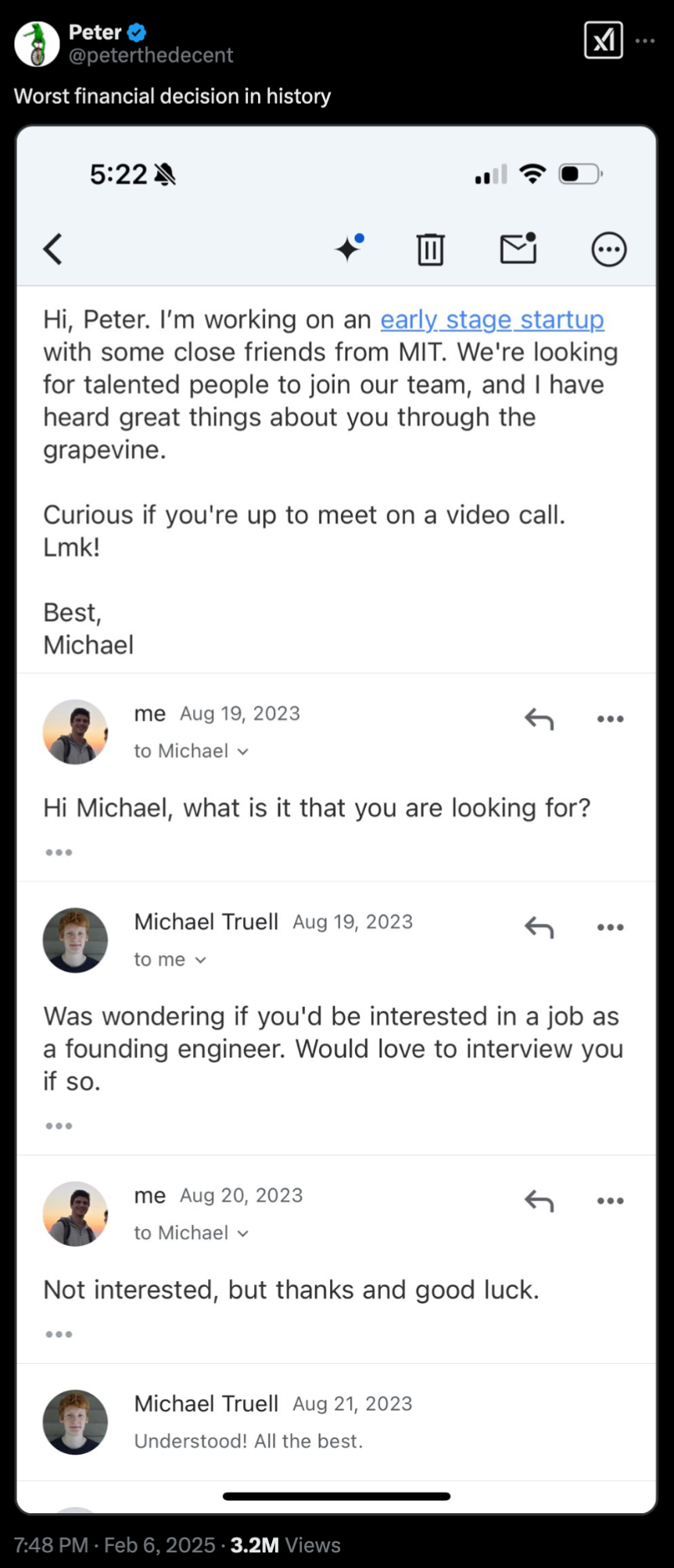

Contrary to what many think, early-career cash pay at YC startups is often similar to, or the same as, what you'd get at big tech firms. Seed rounds in the last decade have ballooned to be $2-3M+. We ourselves have raised $5.3M in seed funding to date, with talent being our primary spend.

Seed round sizes over time, via Cartas

Equity

YC startups tend to have a valuation cap of ~$20M when they raise seed rounds. While this isn’t the same thing as a valuation as you would see in a Series A or later round, they do represent the investor’s perceived investment risk. They are saying there is a >2% chance that this turns into a billion dollar company.

If you’re a founding engineer awarded 1% of the company, your equity is crudely worth $200,000. Vested over four years, this is, on the surface, not too different from the Facebook offer.

There are, of course, two key differences:

- The median startup's equity is goes to zero. That is to say, the median startup fails. This is not true of large public companies, which tend to be less volatile.

- Startup equity is illiquid for a long time. Some companies like Brex offer to buy employee shares or allow outside investors to do so, others don’t, and you might have to wait years until an acquisition or IPO.

So if the expected value of startup equity at seed is similar to the expected value of Facebook’s stock grant, but the latter is less volatile and more liquid, why on earth would anyone work as a founding engineer?

From having talked to many current and former founding engineers, there appear to be four reasons:

Politics

On average, larger companies suffer from more politics than startups. The more people there are, the greater the divergence of their vectors, the more collisions and wasted time.

Startups may not have fewer political dynamics, but it's simpler to assess their overall level since you only need to interact with a small number of individuals to gain a complete understanding.

Velocity

Related to size, startups tend to ship a lot, because they don’t need to be as risk-averse and process driven as larger companies. There simply isn’t enough time or managerial bandwidth to slow things down.

Adventure

For some people, the thrill of working at a highly volatile company with a small team is the appeal.

Conviction Around Probability of Outsized Returns

To me, this is the most interesting one. Earlier I mentioned that investors invest in YC startups at a ~20M valuation cap because they expect >2% chance they will turn into billion dollar companies. The truth is, you as a candidate, even just through the interview process, will often get deeper insight into a company than an investor would, who usually gets 30-60 minutes total with the founders before making a decision.

You might just be able to make a more informed decision on which specific company to work at, and outperform the 2% odds.

Now this doesn't change the fact that the median startup still fails, making the equity worthless. However, there is another compelling reason to consider being a founding engineer: the potential for extraordinary returns. While startup equity is high-risk, it offers the possibility of 100X or greater returns - something extremely rare in public markets. To put this in perspective, NVIDIA is the only major tech stock to achieve a 100X return within a 10-year period this century. In contrast, over 5% of Y Combinator startups become unicorns (companies valued at $1B+), which typically represents at least a 100X return for early employees. This asymmetric upside potential - where the downside is capped at zero but the upside is essentially unlimited - is unique to startup equity.

In essence, working at an early-stage startup presents a binary outcome: it could make you enormously wealthy if the company becomes a unicorn, or leave you with nothing if it fails. However, you can significantly improve your odds of success by carefully evaluating key signals before joining:

Revenue Growth: Look for startups showing strong month-over-month growth and product-market fit

Founding Team: Assess the founders' track record, technical capabilities, and ability to execute

Investors: Research the investors - certain firms have strong records of picking winners

Market Opportunity: Consider if the startup is targeting a large and growing market

The economics of being a founding engineer are peculiar. You're essentially taking a pay cut and accepting illiquid equity in exchange for a lottery ticket - but it's a lottery ticket where you get to thoroughly inspect the odds beforehand. While most founding engineers will end up with worthless equity, the ones who choose wisely and join the right startup at the right time can see returns that are simply impossible to achieve as an employee at a public company. It's a high-stakes game of calculated risk-taking, where thorough due diligence and strong conviction in your assessment can help tilt the odds in your favor.